Unlocking the blue-sky potential of this open deposit

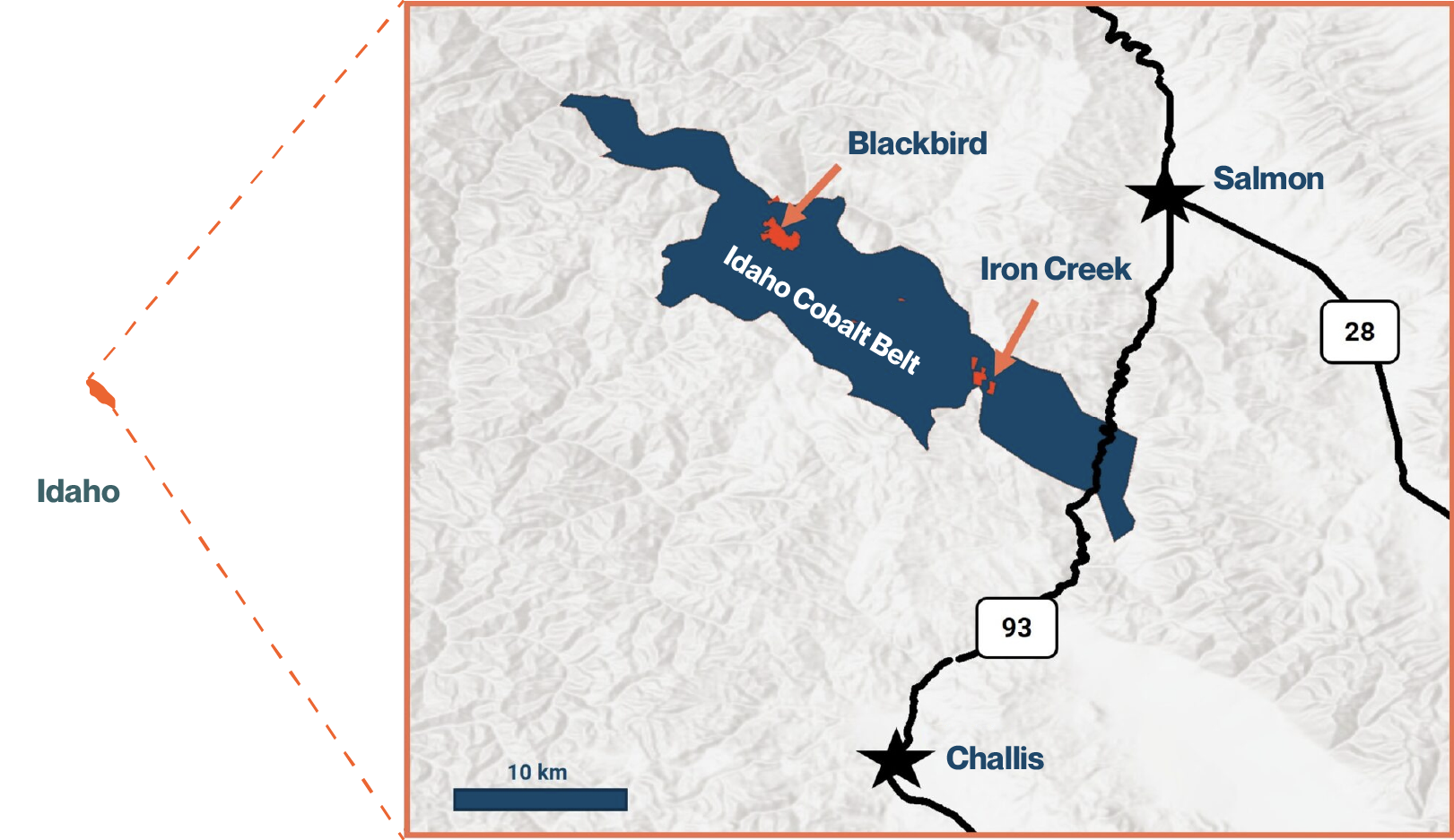

The Iron Creek Project consists of mining patents and exploration claims over an area of 3,300 hectares covering the strike extent of strata hosting mineralization. Historic underground development at Iron Creek includes 600 metres of drifting from three adits. A road connects the property to a state highway and nearby towns, Challis and Salmon. Iron Creek is one of several cobalt-copper resources and prospects within the Idaho Cobalt Belt, a prospective mineralized system that contains the largest primary resources of cobalt in the United States, according to the U.S. Geological Survey.

IDAHO, USA - A long and rich mining history and supportive state policies

Idaho is home to the largest cobalt belt in the United States, including the former producing Blackbird Mine that was in operation from 1902 – 1968. Multiple additional occurrences of cobalt occur throughout the belt which have seen overall limited exploration.

The Idaho Cobalt Belt deposits are sediment hosted copper cobalt systems that are comparable to some of the largest sedimentary hosted cobalt deposits in the world located in the DRC and Zambia.